2023年8月8日

分享五篇《最佳微小說》

2023年8月7日

晶片巨頭,其一生的工作處於科技冷戰的中心 The Chip Titan Whose Life’s Work Is at the Center of a Tech Cold War

晶片巨頭,其一生的工作處於科技冷戰的中心

The Chip Titan Whose Life’s Work Is at the Center of a Tech Cold War

At 92, Morris Chang, the founder of Taiwan Semiconductor Manufacturing Company, can no longer stay in the shadows.

In a wood-paneled office overlooking Taipei and the jungle-covered mountains that surround the Taiwanese capital, Morris Chang recently pulled out an old book stamped with technicolor patterns.

It was titled “Introduction to VLSI Systems,” a graduate-level textbook describing the intricacies of computer chip design. Mr. Chang, 92, held it up with reverence.

“I want to show you the date of this book, 1980,” he said. The timing was important, he added, as it was “the earliest piece” in a puzzle that came together for him — altering not only his career but also the course of the global electronics industry.

The insight that Mr. Chang gained from the textbook was deceptively simple: the idea that microchips, which act as the brains of computers, could be designed in one place but manufactured somewhere else. The notion went against the semiconductor industry’s standard practice at the time.

So at the age of 54, when many people begin thinking more about retirement, Mr. Chang instead put himself on a path to turn his insight into a reality. The engineer left his adopted country, the United States, and moved to Taiwan where he founded Taiwan Semiconductor Manufacturing Company, or TSMC. The company does not design chips, but it has become the world’s biggest manufacturer of cutting-edge microprocessors for customers including Apple and Nvidia.

Today, the company that partially exists because of a textbook is a $500 billion juggernaut that has put the most advanced chips in iPhones, cars, supercomputers and fighter jets. So critical are its airplane-hangar-size chip factories, called fabs, that the United States, Japan and Europe have courted TSMC to build them in their neck of the woods. Over the past decade, China has also invested hundreds of billions of dollars to recreate what TSMC has done.

Mr. Chang’s unlikely entrepreneurial journey helped Taiwan become an economic giant, restructured the way the electronics industry worked and ultimately charted a new geopolitical reality in which a linchpin of global economic growth lies in one of the world’s most volatile spots.

That has thrust Mr. Chang, and the company he created, into the spotlight. And at the twilight of his career, a man who has preferred to remain in the shadows reflected on what he has built and what it means to no longer be able to stay under the radar.

“It doesn’t make me feel particularly good,” said Mr. Chang, who retired in 2018 but still appears at TSMC events. “I would rather stay relatively unknown.”

Over a recent three-hour discussion in his office, Mr. Chang made it clear that he identifies as American — he obtained his U.S. citizenship in 1962 — at a time when the company he founded is at the center of a technological Cold War between the United States and China. Even as the rivalry for tech leadership intensifies, he does not give China much of a chance for semiconductor supremacy.

“We control all the choke points,” Mr. Chang said, referring collectively to the United States and its chip-making allies such as the Netherlands, Japan, South Korea and Taiwan. “China can’t really do anything if we want to choke them.”

More than a dozen people familiar with Mr. Chang, many of whom knew him as a colleague at TSMC, said he built the company — and outmaneuvered giants like Samsung and Intel — by being meticulous, stubborn, trusting his best people and, crucially, having boundless ambition and making daring moves when justified. When TSMC stumbled after the 2008 financial crisis, he returned as chief executive at age 77 to take over again.

“He’s probably the only person left in the chip industry who was present at the creation of the industry itself,” said Chris Miller, the author of the book “Chip War” and an associate professor of international history at the Fletcher School at Tufts University. “That he’s not only still in the industry but at the center and top of it is extraordinary.”

To understand the tech industry’s future, it is crucial to understand the world through Mr. Chang’s eyes and how he made that initial bet when others didn’t. And unlike today’s tech moguls — such as Elon Musk and Mark Zuckerberg, who have publicly considered a cage fight — Mr. Chang has shown more restraint. If competition between the global tech giants is a series of high-stakes poker games, he is the quiet man who runs the casino.

The TSMC Museum of Innovation in Hsinchu, Taiwan. When Morris Chang founded TSMC in 1987, The business exemplary was clear in his caput and he had plans for TSMC to pat into a world market. Credit...Lam Yik Fei for The New York Times

Almost an automaker

Mr. Chang was born in 1931 in a China on the brink of war. Before the age of 18, he lived in six cities, changed schools 10 times, experienced bombings in Guangzhou and Chongqing, and crossed the front lines as his family fled Japanese-occupied Shanghai during World War II.

When he made it to Hong Kong in 1948 with his family, who by then were trying to get away from the Chinese Communist Party’s advancing army, there was no going back.

“My old world crumbled as the mainland changed its color, and a new world was yet to be established,” he wrote in his autobiography, which was published in 1998.

In 1949, Mr. Chang moved to the United States, attending Harvard before transferring to the Massachusetts Institute of Technology to study mechanical engineering. In 1955, when he twice failed a qualifying exam for a doctoral degree at M.I.T., he decided to test out the job market.

“Many years later, I considered failing to be admitted to the Massachusetts Institute of Technology’s Ph.D. program as the greatest stroke of luck in my life!” he wrote in his autobiography.

Two of the best offers arrived from Ford Motor Company and Sylvania, a lesser-known electronics firm. Ford offered Mr. Chang $479 a month for a job at its research and development center in Detroit. Though charmed by the company’s recruiters, Mr. Chang was surprised to find the offer was $1 less than the $480 a month that Sylvania offered.

Inside a TSMC chip factory in Hsinchu. “I really had no plan to set up TSMC, to set up any company in Taiwan,” Mr. Chang said. Credit...Lam Yik Fei for The New York Times

When he called Ford to ask for a matching offer, the recruiter, who had previously been kind, turned hostile and told him he would not get a cent more. Mr. Chang took the engineering job with Sylvania. There, he learned about transistors, the microchip’s most basic component.

“That was the start of my semiconductor career,” he said. “In retrospect, it was a damn good thing.”

Three years at Sylvania opened doors and cemented Mr. Chang’s passion for semiconductors. But Sylvania struggled, teaching him a lesson that would inform how he later ran TSMC.

“From the beginning, the semiconductor industry has been a fast-paced and unforgiving industry,” Mr. Chang wrote of Sylvania’s eventual collapse in his autobiography. “Once you fall behind, catching up becomes considerably difficult.”

In 1958, he jumped to a buzzy new semiconductor company, Texas Instruments. The Dallas company was “youthful and energetic,” with many employees working over 50 hours a week and sleeping overnight in the office. Four years later, Mr. Chang became an American, an identity he considers primary.

“Ever since I fled Communist China and went to the United States and became naturalized in 1962, my identity has always been American, and nothing else,” he said.

Mr. Chang became a pillar of Texas Instruments’ then world-beating semiconductor business. Breakthroughs were constant. In the 1970s, the firm produced a chip that could synthesize the human voice, which led to the famed Speak & Spell toy, a hand-held device that helped children with spelling and pronunciation.

“It’s just like Camelot, but it was not a long period of time,” he said.

In the late 1970s, Texas Instruments turned its focus to the burgeoning market for calculators, digital watches and home computers. Mr. Chang, then in charge of the semiconductor side, realized his career there was approaching a “dead end.”

It was time for something different.

When TSMC held an event at a plant in Arizona last year, Mr. Chang delivered remarks. The United States, Japan and Europe have in recent years courted TSMC to build hangar-size chip factories, called fabs, in their neck of the woods. Credit...Adriana Zehbrauskas for The New York Times

Putting the puzzle pieces together

If the first puzzle piece that led to TSMC’s creation was the textbook, the second was an experience that Mr. Chang had toward the end of his time at Texas Instruments.

In the early 1980s, Texas Instruments opened a chip factory in Japan. Three months after the production line began churning out chips, the plant’s “yield” was double that of the company’s factories in Texas. Yield is a key statistic that refers to how many usable chips emerge from production.

Mr. Chang was dispatched to Japan to solve the yield mystery. The key was the staff, he found, with turnover surprisingly low among well-qualified employees.

But try as it might, Texas Instruments could not find the same caliber of technicians in the United States. At one U.S. plant, the top candidate for a supervisor job had a degree in French literature and no engineering background. The future of advanced manufacturing appeared to be in Asia.

In 1984, Mr. Chang joined General Instrument, another chip firm, where a third puzzle piece fell into place. He met an entrepreneur who later started a company that would only design chips without also making them, which was then uncommon. He spotted a trend that would prove to have staying power: Today most semiconductor companies design chips and outsource manufacturing.

This final piece coincided with Taiwan’s transition from a labor-intensive and heavy industry economy to a high-tech one. When Taiwanese officials set their sights on developing the semiconductor industry, they asked Mr. Chang, whose reputation as a chip expert was established, to lead an institute for supercharging innovation.

So in 1985, Mr. Chang, then 54, left the United States for a place he knew only from several visits to a Texas Instruments factory.

“I certainly had no plan to spend nearly so much time in Taiwan,” he said. “I thought I was going back in maybe just a few years, and I really had no plan to set up TSMC, to set up any company in Taiwan.”

Within weeks of Mr. Chang’s arrival, Li Kwoh-ting, a government official who became known as the godfather of Taiwan’s tech development, asked him to make the state-led chip project commercially viable.

The TSMC office in the Southern Taiwan Science Park in Tainan. Mr. Chang’s entrepreneurial journey and success helped Taiwan become an economic giant and restructured the way the electronics industry worked. Credit...Lam Yik Fei for The New York Times

When Mr. Chang assessed Taiwan’s strengths and weaknesses, he sensed an opening. “I concluded that Taiwan was a lot more similar to Japan than the U.S.,” he said, referring to his experience with the Texas Instruments’ factory in Japan.

In 1987, Mr. Chang founded TSMC. The business model was clear in his head: TSMC would make chips for other companies and not design them. That meant it just had to win over those inside the industry and then focus on what it could do best — manufacturing.

From the get-go, Mr. Chang had plans for TSMC to tap into a global market. He introduced professional management systems, which were uncommon in Taiwan, at the company. To foster an international environment, internal communications were in English.

His vision proved prophetic. As semiconductors became more complex and expensive to produce, only a few firms could even afford to try. Making chips involves hundreds of steps that pull on advanced lasers and chemical manipulations to create tiny pathways for electronic signals that do the most basic calculations for a computer. Costs were astronomical.

Over the years, Mr. Chang kept going as others dropped out. If TSMC could attract enough customers, leveraging economies of scale, it had a chance to take out the kings: Intel and Samsung.

In 1997, Mr. Chang recruited a new head of research of development, Chiang Shang-yi. He told Mr. Chiang to benchmark TSMC against the industry leader, Intel.

“Our goal is to be No. 1, barring none,” Mr. Chang said.

Mr. Chiang was surprised. “To be No. 1, you have to spend three times as much as your next competitor,” he replied, implying that being in the lead would be too lofty and costly a goal.

“It may be three times, but I do want to spend enough so that we become No. 1,” Mr. Chang said. And he was prepared to be patient, even after stepping down as TSMC’s chief executive in 2005 and staying on as the company’s chairman.

Closing the Apple contract

In April 2009, angry TSMC employees — many who had recently been let go by the company — set up a protest camp at a leafy playground in Taipei’s quiet residential neighborhood of Dazhi. They were down the street from Mr. Chang’s upscale apartment building.

As dark fell, the protesters rolled out sleeping bags next to a slide and jungle gym, covering themselves with a large sign that read “TSMC lies lies lies.” Throughout its more than two-decade history, TSMC had never laid off employees. Yet after the 2008 financial crisis, Mr. Chang’s successor, Rick Tsai, began letting employees go.

Mr. Chang, then 77, decided he could no longer stay on the sidelines. He took back his job, rehired the talent Mr. Tsai had let go and more than doubled TSMC’s spending.

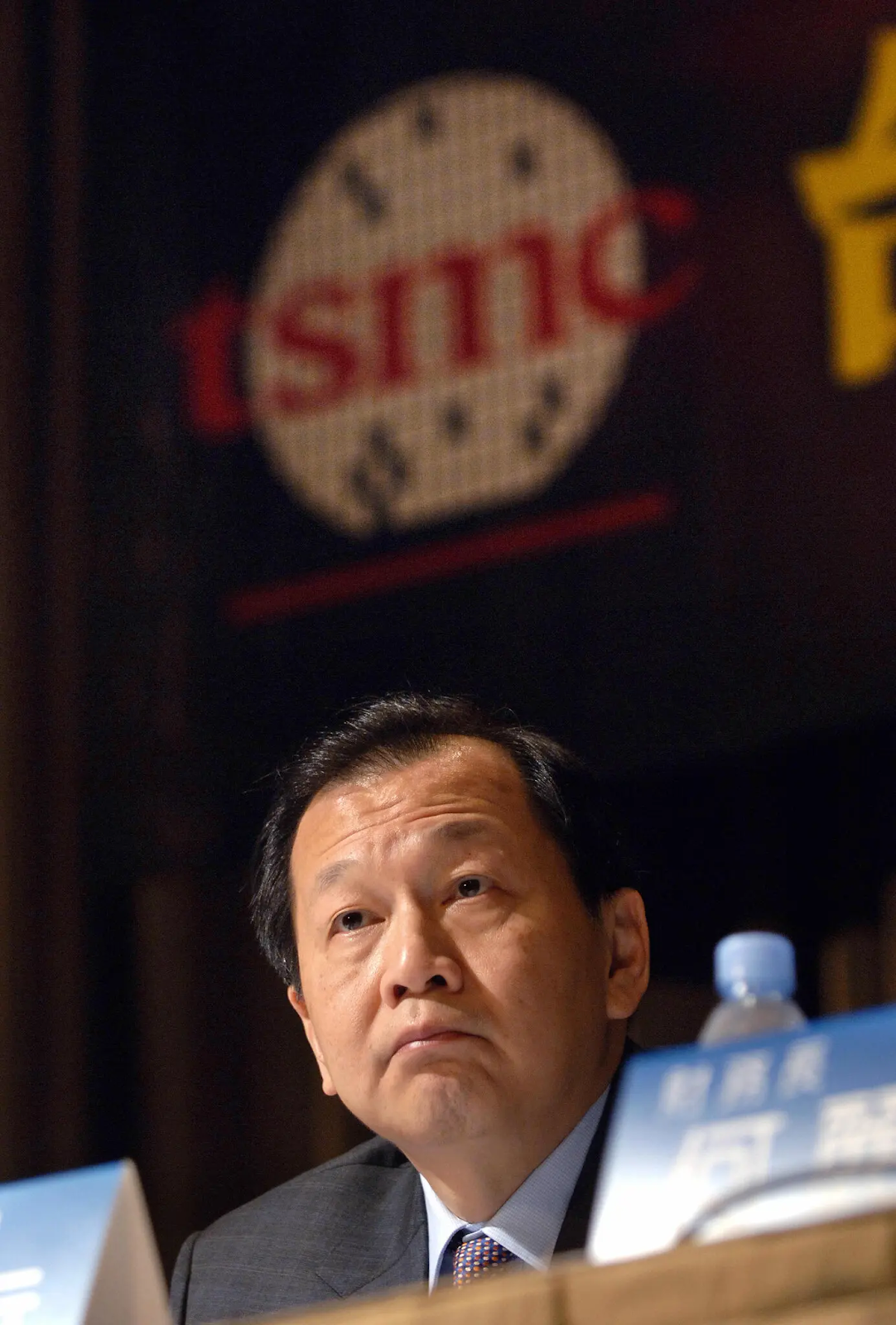

After the 2008 financial crisis, Rick Tsai, Mr. Chang’s successor, began letting go employees. In 2009, Mr. Chang, then 77 and four years into retirement, took back his job and rehired the talent Mr. Tsai had laid off. Credit...Sam Yeh/Agence France-Presse — Getty Images

Coming at a tough time for the industry, the move was not appreciated by investors. Elizabeth Sun, TSMC’s former head of investor relations, recalled her reaction to the news: “When I heard it, I felt like banging my head against a wall.”

But the bet paid off. In 2010, Mr. Chang got the call that would turbocharge TSMC’s growth and clinch its lead over Samsung and Intel. Jeff Williams, a senior vice president at Apple, reached out through Mr. Chang’s wife, Sophie Chang, who is a relative of Terry Gou, the founder of Foxconn, Apple’s largest assembler.

The call led to a Sunday dinner with all four of them, which turned into negotiations the next day. Apple had worked with Samsung to produce the microchip it designed for the iPhone, but it was looking for a new partner, partly because Samsung had become a major smartphone competitor. TSMC, which does not compete with its customers, was in pole position for the contract.

The discussions stretched on for months. “It was very complicated — the contract itself,” Mr. Chang said. “It was the first time we ran into this kind of thing.”

At one point, Apple announced a two-month pause in talks. Mr. Chang heard Intel might have intervened.

Worried, Mr. Chang flew to San Francisco to meet Tim Cook, Apple’s chief executive, who reassured him. In a 2013 interview, Paul Otellini, then Intel’s chief executive, said he had turned down the chance to make the chips for the iPhone because Apple would not pay enough.

Mr. Chang would not make the same mistake. Apple demanded better terms and lower prices than others, but he understood the contract’s scale would help TSMC rocket past competitors. That was a lesson he learned from Bill Bain, who founded the consulting firm Bain & Company, back at Texas Instruments.

Tim Cook, Apple’s chief executive, left, shared a toast with Mr. Chang in Phoenix last year. Credit...Caitlin O'Hara/Bloomberg

Mr. Bain, then a consultant for Boston Consulting Group, had worked in an office next to Mr. Chang for almost two years. He had analyzed Texas Instruments’ production and sales numbers and argued that the more the company produced, the better it would perform.

When the deal with Apple was complete, Mr. Chang borrowed $7 billion to build the capacity for making millions of chips for the iPhone.

In the ensuing years, Apple briefly turned to Samsung for iPhone chip production again, but TSMC became its primary chip maker. Apple is now TSMC’s largest client, accounting for about 20 percent of revenue.

Mr. Chang remains cautious about what he says about TSMC’s customers even now. After beginning a story about Apple at his office, he wondered whether he had said too much.

“I don’t think I have exceeded Apple’s limits of what to tell you,” he said.

In a statement, Mr. Williams, now Apple’s chief operating officer, said Mr. Chang had “pushed the semiconductor industry to new frontiers.”

In 2018, Mr. Chang, at 86 years old, retired again. By then, TSMC had succeeded where others lagged, mass producing chips with electronic pathways the size of a DNA double helix. That gave Mr. Chang confidence that he had achieved a key tenet for TSMC: technological leadership.

Spurring the A.I. revolution

Among the awards and photos with world leaders that stud the walls of Mr. Chang’s Taipei office, one is a framed comic portraying his close relationship with Jensen Huang, a founder of the chip firm Nvidia.

If Apple turbocharged TSMC, it was Mr. Chang who helped make Nvidia the world’s most important designer of artificial intelligence chips. The cartoon tells the story. In the mid-1990s, when Nvidia was a start-up, Mr. Huang sent a letter to Mr. Chang asking if TSMC would make its chips. After a call with Mr. Huang, Mr. Chang agreed.

“I liked him,” Mr. Chang said of Mr. Huang.

By taking that chance, Mr. Chang helped spur the A.I. revolution in the United States. With TSMC’s manufacturing, Nvidia became the world’s most important A.I. chip designer. Breakthroughs like generative A.I. rely on huge numbers of Nvidia chips to find patterns in vast amounts of data.

In a 2018 speech at Mr. Chang’s retirement gathering, Mr. Huang said Nvidia — now worth $1 trillion — would not exist without TSMC. An inscription on the comic, which Mr. Huang gave to Mr. Chang, reads: “Your career is a masterpiece — a Beethoven’s Ninth Symphony.”

Mr. Chang, left, with Jensen Huang, the chief executive of Nvidia, in Phoenix last year. If Apple turbocharged TSMC, it was Mr. Chang who helped make Nvidia the world’s most important designer of artificial intelligence chips. Credit...Ross D. Franklin/Associated Press

For Mr. Chang, the final notes of that masterpiece have not yet been played. He is healthy for a nonagenarian, though he can no longer smoke a pipe — once his trademark in photos — after he had stents put into his heart a few years ago.

At his office, he still keeps a Bloomberg terminal. He also makes regular public appearances around Taiwan to discuss global politics and the economy. Like many, he worries about a potential conflict between the United States and China over Taiwan, though he believes the chance of such a confrontation is low.

“The chance of China invading Taiwan, amphibious warfare and all that stuff, I think that’s a very, very low probability,” he said. “A blockade of some kind, I think I still put it as low probability, but it’s still a chance and I want to avoid that.”

Mr. Chang said he was not worried about U.S. policies that have cut off Chinese firms from access to cutting-edge semiconductor technology.

“I think it’s still OK,” he said, though he noted U.S. companies would lose business and China would find ways to fight back.

As the conversation wound down, Mr. Chang said he had some regrets that he could not be in the driver’s seat as TSMC faces geopolitical challenges. But he said the timing of his retirement in 2018 made sense, driven by technology and not politics.

“I was literally sure that we had achieved technology leadership,” he said of that time. “I don’t think we’ll lose it.”

2023年8月6日

台積電為何將繼續保持在台灣根基,即使全球擴張

台積電為何將繼續保持在台灣根基,即使全球擴張

在一次採訪中,晶圓代工龍頭台積電董事長劉德音解釋了為什麼該公司頂尖的科技會留在台灣,儘管面臨中國的威脅以及美國的擔憂。台灣積體電路製造公司(TSMC)在全球最地緣政治不穩定的地區之一的台灣進行業務。

這使得華盛頓的人們非常緊張。台積電主宰著半導體產業,美國無法脫離的一家公司,就位於距離中國海岸80英里的台灣。

美國政府已經撥款數百億美元來加強美國自己的半導體行業,並幫助資助台積電在美國的新興業務,遠離中國,中國從未放棄使用武力吞併台灣。

但是台積電自己在台灣投資了數十億美元,歷時近四十年在台灣建立了深厚的根基。在那裡,它聘用了大批的工程師、研發科學家、技術人員和生產工人,從事精密複雜的晶片製造工作,將電子元件刻上矽晶片的表面,其大小比一個細胞還要小。

劉德音,台積電董事長表示,在其他地方很難複製台灣台積電所建立的東西。開發和生產公司最尖端的芯片需要巨大的努力,一代技術可能需要多達3000名研究科學家。

他說:“我們無法將它放在其他地方。”

台積電已經展開全球擴張計劃,包括在美國以及在日本各建設一個工廠,同時可能在德國建設一個工廠。這是該公司應對美國官員呼籲減少對台灣製造的晶片依賴的戰略的一部分。

這使得現年68歲的劉德音(他擁有電子工程和計算機科學博士學位)成為一位外交官和科學家以及高管。30年前,在英特爾和貝爾實驗室任職後,他加入了台積電,並逐步晉升至今日擔任這家價值5000億美元的公司的董事長,公司的首席執行官和副董事長魏哲家。

在六月底,當他在台灣北部城市新竹的台積電辦公室接受《紐約時報》訪問時,他剛從一次前往美國的旅行中回來,他表示他大約每三個月訪問一次美國。

TSMC成立全球半導體領域競賽

台積電:我們與台灣晶片製造商的創辦人張忠謀和董事長劉德音談論了該公司的過去和未來,隨著公司擴大業務,發現自己處於科技冷戰的中心。

矽封鎖:拜登政府認為通過切斷中國的先進計算機晶片,可以保持美國的技術主導地位。這個計劃可能會產生反效果?

晶片法案:為限制聯邦支出而達成的交易,以暫停債務上限,引發了人們對於這項提高美國半導體行業的雙方協議是否會獲得所有承諾資金的擔憂。

美國的工人短缺:在獲得數十億美元的聯邦資金支持下,美國的半導體公司計劃創造數千個就業機會。但可能沒有足夠的人來填補這些職位。

他說:“我們與國會、商務部、白宮有著相當良好的關係。我想他們了解我們。”

這話有點過於保守。最初試圖招攬台積電並將其生產設施引進美國的努力,導致了《晶片與科學法》的創建,這是一個擴大美國半導體行業的計劃。

台積電在這個行業中的領先地位是如此完全,以至於沒有明顯的第二選擇可以做到它所做的一切。任何涉及台灣的衝突——台灣是其製造業的絕大部分所在地——都將阻止台積電微晶片的流動,使技術產業陷入深度冷凍狀態,進而影響全球經濟。

符合一家公司為保護其艱苦取得的技術領先地位而著迷的特點,台積電的辦公室更像是一個保密的政府研究機構,而不是矽谷的校園。

在員工刷卡的旋轉閘旁邊,有一個標誌,指出自2010年以來有五人因違反公司嚴格的內部安全規則而被解雇。其中一個違規行為包括在回復郵件時未正確更改主題行。外部電話被禁止。儘管政策最近已放寬,但員工們講述了在停車場吃午飯的故事,以便能使用自己的手機。

大小相當於飛機庫的無窗大樓每天24小時運作,生產微晶片,即智能手機、飛機、超級計算機和幾乎所有其他電子設備內部的小型晶片。

美國及其在與中國的貿易戰中的盟友的政治領袖一直敦促台積電在台灣以外的地方建立生產設施。中國也竭力與台積電競爭,使用從黑客攻擊和知識產權盜竊到數千億美元的投資等一切手段。

隨著美國試圖阻礙中國在半導體技術上的進展,台積電陷入了困境。在2020年,台積電中止了對中國科技巨頭華為的訂單,當時華為是台積電的第二大客戶。劉德音表示,由於台積電依賴於美國的技術,他們別無選擇。

他說:“這是可以理解的,但是不管是否支持,我們無話可說。”

劉德音否定了「矽盾」的觀念:即台灣的晶片製造實力阻止中國的軍事行動,並獲得美國的支持。兩者都需要台灣的晶片。

他說:“中國不會因為半導體而入侵台灣。中國也不會因為半導體而不入侵台灣,”他說。“這真的取決於美國和中國:他們如何維持雙方都希望的現狀?”

台積電在亞利桑那州投資了400億美元,建設了兩個生產比其最先進的晶片落後一到兩代的晶片的工廠。預計該公司將在本月提交《晶片法案》的補貼申請。

亞利桑那州的廠房進展緩慢,公司已經派遣數百名台灣技術人員加快進程。上個月,公司將預計的開始生產日期推遲了一年,到2025年,並面臨著高昂的成本和管理上的挑戰。台積電和美國工人之間的文化差異也帶來了內部緊張局勢。

對於美國公司是否愿意支付可能需要的亞利桑那州芯片的溢價,存在疑慮,因為台積電的建設成本可能至少是在台灣的四倍。劉德音表示,他已經告訴美國政府,美國公司需要提供額外的激勵,超出《晶片法案》520億美元的補貼,來購買美國製造的芯片。

他說:“否則,這將是有限的,”他說。“它很快就會受到限制。所以這是在討論中。但我認為我們還沒有解決方案。” 負責處理《晶片法案》激勵措施的商務部對於具體公司的評論不予置評。

劉德音表示,2018年,川普政府的商務部敦促公司在美國投資。一些台積電的客戶在行業會議上私下接近劉德音,表達了需要其在美國建立生產設施的需求。劉德音感覺到情勢正在發生變化。

他說:“我想也許是時候讓台積電走向全球,因為我知道我們的技術在今天領先,但未來呢?”

不久之後,川普政府的國務院出於國家安全的理由開始招攬台積電,強調先進晶片在像F-35戰機之類的軍事裝備中的作用。負責經濟增長、能源和環境事務的副國務卿基思·克拉奇安排了劉德音、國務卿邁克·蓬佩奧和商務部長威爾伯·羅斯之間的電話通話。

劉德音回憶說,龐培歐表示,台積電需要幫助「催化」美國的半導體行業。

劉德音說:“對我來說,這也很重要,因為我們的65%客戶在美國。”他說。“他們有不同的需求,而我們也有機會。”

https://www.nytimes.com/2023/08/04/technology/tsmc-mark-liu.html?action=click&module=Well&pgtype=Homepage§ion=Technology

Why TSMC Will Keep Its Roots in Taiwan, Even as It Goes Global

In an interview, the chip maker’s chairman, Mark Liu, explained why TSMC’s top tech would stay in Taiwan, despite growing threats from China and worries from the United States.

Taiwan Semiconductor Manufacturing Company, which is manufacturing the world’s most advanced microchips, conducts business on the island of Taiwan, dead center in one of the most geopolitically volatile places on the planet.

That makes people in Washington very nervous. TSMC dominates the semiconductor industry; it’s a company that the United States can’t do without, 80 miles off the coast of China.

The U.S. government has appropriated tens of billions of dollars to strengthen America’s own semiconductor sector and help fund TSMC’s nascent operations in the United States, far from China, which has never renounced the use of force to absorb Taiwan.

But TSMC has invested billions of its own over nearly four decades growing deep roots in Taiwan. There, it employs a small army of engineers, research and development scientists, technicians and production workers in the exquisitely complex task of producing chips, etching electronic pathways smaller than a cell on plates of silicon.

It would be exceedingly difficult to replicate what TSMC has built in Taiwan, said Mark Liu, chairman of TSMC. Developing and producing the company’s most cutting-edge chips at a rapid pace requires a huge effort, he said, as many as 3,000 research scientists for one generation of the technology.

“We cannot put it anyplace else,” he said.

TSMC has embarked on a global expansion, with two factories under construction in the United States and one in Japan, as well as a possible facility in Germany. It’s part of the company’s strategy to address the calls by U.S. officials to reduce America’s reliance on chips made in Taiwan.

That makes the 68-year-old Mr. Liu, who holds a doctoral degree in electronic engineering and computer science, as much a diplomat as a scientist and an executive. He joined TSMC 30 years ago after stints at Intel and Bell Labs, rose through the ranks and today runs the $500 billion company with its chief executive and vice chairman, C.C. Wei.

In late June, when he spoke to The New York Times at TSMC’s offices in the northern Taiwan city of Hsinchu, he had just returned from a trip to the United States, which he said he visits roughly every three months.

The Global Race for Computer Chips

TSMC: We spoke to the Taiwanese chip maker’s founder, Morris Chang, and its chairman, Mark Liu, about the company’s past and future as it expands its reach and finds itself at the center of a tech Cold War.

A Silicon Blockade: The Biden administration thinks it can preserve America’s technological primacy by cutting China off from advanced computer chips. Could the plan backfire?

CHIPS Act: A deal to limit federal spending in exchange for suspending the debt ceiling has raised concerns about whether the bipartisan law to boost the U.S. semiconductor industry will receive all of its promised funding.

Worker Shortage in U.S.: Strengthened by billions of federal dollars, America’s semiconductor companies plan to create thousands of jobs. But there might not be enough people to fill them.

“We have a pretty good relationship across Congress, the Commerce Department, the White House. I think they know us,” he said.

It’s a bit of an understatement. Initial efforts to court TSMC and bring its production facilities to the United States led to the creation of the CHIPS and Science Act, a program to expand the U.S. semiconductor industry. So complete is TSMC’s lead in the industry that there is no obvious second option for all it does. Any clash over Taiwan — where the vast majority of its manufacturing happens — would stop the flow of the TSMC microchips, putting a deep freeze on the technology industry and, in turn, the global economy.

As befits a company obsessed with protecting its hard-won technological lead, TSMC’s offices feel more like a secret government research facility than a Silicon Valley campus.

Next to turnstiles where workers swipe their badges, a sign notes that five people have been fired since 2010 for breaking the company’s strict internal security rules. One offense included improperly changing the subject line of an email in a reply. Outside phones are banned. Although policies have recently loosened up, employees tell stories of eating lunch in the parking lot so they can access their personal phones.

Windowless buildings the size of aircraft hangars operate 24 hours a day to produce microchips, the tiny brains inside smartphones, airplanes, supercomputers and just about anything else electronic.

Political leaders in the United States and its allies in trade battles with China have pushed TSMC to build production facilities outside Taiwan. And China has tried hard to compete with TSMC, using everything from hacks and intellectual property theft to hundreds of billions of dollars in investment.

As the United States has sought to hinder China’s advances in semiconductor technology, TSMC has been caught in the middle. In 2020, TSMC cut off orders to the Chinese tech powerhouse Huawei, which was TSMC’s second-largest customer at the time. Mr. Liu said TSMC, because it is reliant on American technology, had no choice.

“It’s understandable, but support or not, we have no say,” he said.

Mr. Liu rejected the idea of the “silicon shield”: that Taiwan’s chip-making prowess deters military action by China and brings support from the United States. Both need Taiwan’s chips.

“China will not invade Taiwan because of semiconductors. China will not not invade Taiwan because of semiconductors,” he said. “It is really up to the U.S. and China: How do they maintain the status quo, which both sides want?”

TSMC has made a $40 billion investment in Arizona to build two factories to produce chips that are one or two generations behind its most advanced ones. The company is expected to submit its application for CHIPS Act subsidies this month, Mr. Liu said.

The Arizona plants have been slow going, and the company has deployed hundreds of Taiwanese technicians to expedite the process. Last month it pushed back the expected start date by a year to 2025, and it has faced high costs and managerial challenges. Internal tensions over cultural differences have surfaced between TSMC and American workers.

And doubts loom over whether American companies will be willing to pay the likely premium required for chips made in Arizona, where TSMC’s construction costs alone could be at least four times higher than they are in Taiwan. Mr. Liu said he had told the U.S. government that it needed to offer American companies incentives, beyond the $52 billion in subsidies in the CHIPS Act, to buy American-made chips.

“Otherwise, it will be limited,” he said. “It will come to limits pretty quickly. So that is on the table. But I don’t think we have a solution yet.” The Commerce Department, in charge of handling CHIPS Act incentives, declined to comment on specific companies.

In 2018, Mr. Liu said, the Commerce Department under President Donald J. Trump urged the company to invest in the United States. And several TSMC clients privately approached Mr. Liu at an industry conference and expressed the need for it to establish a U.S. manufacturing presence. Mr. Liu sensed the landscape was shifting.

“I thought maybe it’s time for TSMC to go a little bit global, because I know our technology is leading today, but what about in the future?” he said.

Before long, the Trump administration’s State Department, citing national security grounds, started courting TSMC, emphasizing the role of advanced chips in military gear like F-35 fighter jets. Keith Krach, under secretary of state for economic growth, energy and the environment, arranged a phone call between Mr. Liu, Secretary of State Mike Pompeo and Commerce Secretary Wilbur Ross.

Mr. Liu recalled that Mr. Krach said TSMC was needed to help “catalyze” the American semiconductor industry.

“That for me is also important because the U.S. is where 65 percent of our customers reside,” Mr. Liu said. “They have different needs, and we also have opportunities.”

2023年7月29日

[影片下載]如何下載抖音無浮水印影片?dlpanda無浮水印連結 / SnapTik 速度快、下載無浮水印TikTok 抖音影片的免費工具

如何下載抖音影片?

dlpanda無水印連結:https://dlpanda.com/

使用方法簡單,中文化的介面用起來簡單,直接貼上需要下載的連結就可以先到預覽要下載的影片

在預覽影片下可以選擇到下載影片或者是下載MP3

優點:中文化界面,簡單容易上手

SnapTik 速度快、下載無浮水印TikTok 抖音影片的免費工具

「SnapTik」抖音下載工具,一鍵下載無浮水印影片

想要下載喜歡的TikTok 抖音影片嗎?

1. 在TikTok 抖音找到喜歡的影片選擇「複製連結」,

2. 同時在瀏覽器開啟「SnapTik」網站,把影片連結貼在空白欄位,

3. 點擊綠色的「Doownload」下載按鈕。

《告別了鄰居,我走了!》

《告別了鄰居,我走了!》

作者有上台大和清華的兩兒子,但還是進了養老院!這是目前熱傳的一篇文章,也是在網上引起衆多反省的文字。他,是一位退休作家,即將去養老院時發出的感慨!

我要去養老院了,非不得已,我是不會去養老院的。但是當生活開始不再能完全自理,而兒女又工作忙碌還要照顧孫子,無暇顧及你時,這似乎成了我唯一的出路。

養老院條件不錯,乾淨的單人房間,配有簡單實用的電器;各種娛樂設施齊全;飯菜還算可口;服務也很周到;環境也很優美;就是價格不菲。

我的退休金肯定無以支撐。但是我有自己的住房,將它賣掉,錢就不是問題了。我養老花不了,不久的將來剩下的就作爲遺產,留給兒子。兒子很理解:你的財產應該您享用,不要考慮我們。剩下的就是我要考慮做去養老院的準備了。

俗話說:破家值萬貫,指的是東西多。過日子針頭線腦什麼也少不了,箱子、櫃子、抽屜都裝滿了各種日常用品:四季的衣服,四季的牀上用品,堆積如山。

我喜歡收藏,郵票集了一大堆;紫砂壺也集了百十來把;還有許多珍藏的小件物品,什麼翠、核桃等小把件、掛件,還有二條小黃魚。特別是書,整個一面牆的書櫃,裝得滿滿的。

好酒什麼洋酒,也存了幾十瓶;還有全套的家用電器;做飯的各種器具,鍋碗瓢盆,柴米油鹽、各種調料,再把個廚房也塞的滿滿的;還有積攢的幾十本像冊...,看着滿滿的一屋子東西,我發愁了!

養老院只有一間屋子,一個櫃子,一張桌子,一張牀,一個沙發,一個冰箱、一個洗衣機,一臺電視機,一個電磁爐,一個微波爐。根本沒有存放我這些平生積攢的財富的地方。

在這一瞬間我忽然覺得,我的這些所謂財富都是多餘的,它們並不屬於我!我只不過是看一看、玩一玩,用一用,它們實際上只屬於這個世界。輪番降臨的生命,都只是過客。故宮是誰的?皇帝認爲是朕的,但是今天,它是人民的,是社會的。

爲什麼比爾·蓋茨要把自己身後的財產全部捐獻;爲什麼馬雲都宣佈要把他博物館的全部藏品全部捐獻...,那是因爲他們明白了:這一切原本就不是他們的,他們不過是看一看,玩一玩,用一用,生帶不來,死帶不去,倒不如沽名釣譽,落得個積善行德。多麼明智!

我的這一屋子東西,真想捐獻,但是拿不出手。要處理現在成了個難題。子孫能接受的寥寥無幾。我能想像,當兒孫面對我的這些苦心積累的寶貝時會是怎樣的情景:衣服被褥全部扔掉;幾十本珍貴的照片會全部毀掉;書被當作廢品賣掉;收集的藏品不感興趣會處理掉;紅木傢俱不實用,會賤價賣掉。

正如紅樓的結尾:只剩下白茫茫的一片,真乾淨!

我面對着如山的服裝,只揀了幾件愛穿的;廚房用品只留了一套鍋碗瓢盆;書挑了幾本還值得看的;紫砂壺挑了一把喝茶的;再帶上身份證、老年證、健保卡、戶口名簿,當然還有銀行卡,足夠了!

就是我的全部家當!我走了,我告別了鄰居,我在門口跪下拜了三拜,我把這個家還給這個世界!

是啊!人生只能睡一張牀,住一間房,再多的都是看着玩的!

人活一輩子終於明白:我們真正需要的東西並不多,不要被多餘的東西束縛住了快樂!

四句話:

爭名奪利挺荒唐

焦慮算計天天忙

等到最後才明白

人生不過一張牀

對於60歲以上一族,是應該好好地想想,人生最後一程的路怎麼走?放下幻想和包袱,放下那些吃不完、穿不盡、也帶不走的東西。

今天 我們這一輩已經近六、七十多歲的人了!說生命過半,毫無懸念;說餘生還長,不可預料!

也許百年不止百歲、 或許明天就是百年。

對個人來說,已度過了漫長超過一甲子;

對歷史而言,只是飄過了一絲雪花的瞬間!

我們這一群同齡人,曾有過理想、作過美夢!

也經歷過飢餓、嘗試過苦難,兒時有過“快樂的童年”"西裝革履”的期盼,大了也享受過電視、電腦、手機的社會進步過程;

幾十年間,上天(飛機)、入地(地鐵),超越了歷代帝王的待遇,隱身(網路)、亮像(視頻)糾結了千古神仙聖賢的智商!

從當年騎自行車出門的美感、到如今駕駛汽車、乘飛機旅遊的平常;從漂洋過海的環球旅行、到曠世縹緲的虛無網游。

我們這一輩,人生經歷跨越了幾千年、生活品質超過了無數代!而如今,從作兒孫,到了當祖輩。從童音朗朗,到了白髮蒼蒼。從捉迷藏跳橡皮筋、到了太極拳練氣功。

我們漸漸老了,我們將走向永恆!但是,我們值得了,我們該知足了!

我們這一輩,沒有經歷兵荒馬亂的戰爭、流離顛沛的逃亡、國破家亡的痛楚、妻離子散的悲傷!

國有不平,我們基本生活無憂;

世有不公,我們安全逍遙自由!

雖也辛勞,卻是為了兒孫!

雖有苦衷,總還對得起人生!

經歷過磨難,卻能劫後餘生!

我們要放飛夢想、 撫平心情、 笑看世界、 樂對人生!特別是這波疫情如果發生在古代也不知道要死到哪裡去了,但是現在我們還搭上了科技發展的末班車,雖然自主隔離管理躲在家裡,讓我們也能line來line去,健康快樂每一天,我們搞網購、新奇物品送身邊,外面不能群聚我們就常聚在群組,同學朋友聊到樂翻天!

知足吧!知足就常樂;

知足吧!知足就幸福;

知足吧!

三、四、五年級的朋友們!保重好身體、愛護好自己、幸福地生活、健康快樂永遠伴隨你!

健康第一,

其他是戲,

快樂活到老,

學到掛牆壁!

我們共同勉勵。

2023年7月28日

台積電全球研發中心啟用:台灣邁向科技領先的新里程碑

**標題:台積電全球研發中心啟用:台灣邁向半導體頂尖科技之路**

**第一章:台積電全球研發中心啟用,政府重視支持**

7/28,台積電全球研發中心在盛大典禮中正式啟用,這個引人注目的事件吸引了政商界人士以及媒體的矚目。陳揆在啟用典禮上表示,政府將全力支持台積電的研發工作,並強調政府將成為台積電在科技領域的靠山。此舉展現了政府對台灣科技產業的高度重視,以及對台積電在半導體領域領先地位的認可。

**第二章:張忠謀鐵血發言,激勵台灣不再像英國海軍**

台積電創辦人張忠謀在啟用典禮上發表了令人深思的演說。他鐵血的發言激勵著台灣科技業不可像英國海軍一樣被浪潮拋在後頭。張忠謀呼籲台灣要在科技競爭中保持警覺,堅持不懈地追求創新,並強調研發實力是台灣成為兵家必爭之地的關鍵因素。

**第三章:劉德音展望研發團隊的未來**

在台積電全球研發中心啟用典禮上,台積電董事長劉德音也發表了關於研發團隊未來的展望。他表示研發團隊將致力於探索2奈米、1.4奈米及以下的技術,這將是半導體製造技術的一大突破。劉德音強調,這項技術的突破將不僅為台灣帶來更多商機,也將助力全球科技產業的發展。

**第四章:台灣成為兵家必爭之地**

張忠謀在啟用典禮上再次強調,強大的研發實力是台灣成為兵家必爭之地的重要因素。他指出,台積電全球研發中心的啟用,將進一步加強台灣在全球半導體產業中的地位,也將為台灣帶來更多的機遇。台灣做為半導體產業的領先者,將在全球科技競爭中扮演著不可或缺的角色。

**第五章:展望台灣科技業的未來**

台積電全球研發中心的啟用無疑將為台灣的科技產業帶來新的動能。這一重要的里程碑將進一步推動台灣在科技領域的發展,讓台灣在全球科技競爭中綻放更加璀璨的光芒。台灣將成為半導體領域的頂尖科技之地,引領全球科技產業的未來。

**結語:台積電全球研發中心的啟用,台灣科技邁向新的輝煌時刻**

台積電全球研發中心的啟用儀式是台灣科技業的重要里程碑。政府對台積電研發工作的支持,張忠謀鐵血的發言,以及劉德音對未來的展望,都體現了台灣科技產業的崛起。台灣在全球科技競爭中正逐步擺脫追隨者的身份,成為頂尖科技領域的引領者。相信隨著台積電全球研發中心的運作,台灣將在半導體產業和其他高科技領域持續綻放光芒,成為全球科技發展的亮眼明星。

2023年7月18日

您知道下面25句俗語的下半句嗎?

分享:

*您知道下面25句俗語的下半句嗎?如果您知道的下半句達20句以上,您有資格當台大中文的教授。

1、久病床前無孝子,

下半句是:久貧家中無賢妻。

2、春宵一刻值千金,

下半句是:花有清香月有陰。

3、近水樓台先得月,

下半句是:向陽花木易為春。

4、恭敬不如從命,

下半句是:受訓莫如從順。

5、小心使得萬年船,

下半句是:謹慎能捕千秋蟬。

6、不忘初心,方得始終,

下半句是:初心易得,始終難守。

7、可憐之人必有可恨之處,

下半句是:可恨之人必有可悲之苦。

8、今朝有酒今朝醉,

下半句是:明日愁來明日愁。

9、初生之.犢不怕虎,

下半句是:待到長成反怕狼。

10、盡人事聽天命,

下半句是:淡心境待時機。

11、浪子回頭金不換,

下半句是:衣錦還鄉做賢人。

12、一失足成千古恨,

下半句是:再回頭是百年人。

13、解鈴還須繫鈴人,

下半句是:心病還須心藥醫。

14、書到用時方恨少,

下半句是:事非經過不知難。

15、樹欲靜而風不止,

下半句是:子欲養而親不待。

16、君子之交淡如水,

下半句是:小人之交甘若醴。

17、色不迷人人自迷,

下半句是;情人眼裡出西施。

18、物以稀為貴,

下半句是:情因老更慈。

19、酒肉穿腸過,

下半句是:佛祖心中留。

20、老來多健忘,

下半句是:唯不忘相思。

21、飽暖思淫慾,

下半句是:饑寒起盜心。

22、長江後浪推前浪,

下半句是:世上新人趕舊人。

23、人逢喜事精神爽,

下半句是;悶向心來瞌睡多。

24、男兒有淚不輕彈,

下半句是:只是未到傷心處。

25、水至清則無魚,

下半句是:人至察則無徒。